Why dubai

- The United Arab Emirates (UAE) - one of the three leading regions in the world in terms of quality of life and security

- 350 sunny days a year

- Dubai is one of the 5 most visited cities in the world

- About 19,000,000 tourists visited Dubai in 2021

- 21,000 restaurants and cafes, 140 five-star hotels

- The population of Dubai is about 12% local Arabs, and 88% residents who immigrated from different countries

- $32,000,000,000 - the amount tourists spend in Dubai every year - a world record

- Most of the developed areas of the world are within a 4-8 hour flight

From which countries do tourists come to Dubai?

With an investment of 705.000AED/205,000 USD

you get a resident visa, which entitles you to:

- Visa for the whole family for at least two years

- Bank Account

- Driving License

- and more..

Dubai Mall - ranked as the fifth-largest in the world. Featuring over 1,200 branded stores and boutiques. Encompassing more than 1 million square meters of commercial space.

0% taxes on:

- Income Tax

- real estate profits

- Capital profits

- dividend

- salary

- inheritance

- Private income (from June 2023, a 9% corporate tax will come into force)

Purchase tax compared to other countries

UK

Australia

Singapore

Israel

Dubai

Dubai

6-15%

Israel

5-7%

Singapore

1-3%

Australia

0-10%

UK

2-4%

purchase tax

Dubai

20%

Israel

10%

Singapore

7%

Australia

17%

UK

5%

VAT

Dubai

10-37%

Israel

30%

Singapore

0-22%

Australia

עד 47%

UK

0%

Income Tax

Dubai Real Estate Authority (Rera)consistently monitors the progress of all projects

- The Land Authority is the official regulatory body overseeing real estate in Dubai.

- All expenditures on assets under construction are directed to trust accounts (the triple), managed by the government.

The bureaucratic stages of land management:

- The developer cannot use the money until a certain stage of construction is reached.

- Upon completion of each construction phase, the developer prepares declaration documents pertaining to the current stage of property development.

- The documents are sent to the bank where the trust account is located.

- If the bureaucratic process is in order, approval is granted to proceed with construction, and the entrepreneur gains access to a specified amount from the account.

The record value of properties in the city was noted in 2014. Currently, the market is recovering from the impact of the COVID-19 pandemic. Experts in Dubai anticipate another increase in the next 5-10 years. 10.993 AED (2.993 USD) The average price per square meter in Dubai

Comparing real estate prices in the most popular cities in the world

Price per square meter

GDP (Gross Domestic Product)

annual return

Yield. 11,90%

GDP. $68,698

SQM. $2,500

Dubai

Yield. 5,40%

GDP. $90,500

SQM. $13,543

New York

Yield. 2,73%

GDP. $43,600

SQM. $17,324

London

Yield. 2,71%

GDP. $43,600

SQM. $11,605

Paris

Yield. 2,44%

GDP. $57,714

SQM. $22,909

Singapore

What makes Dubai reliable?

The business advantages of Dubai and why it is the city of the future

The business advantages of Dubai and why it is the city of the future

Today, Dubai stands out as an attractive destination for investing in residential properties. According to UBS Bank, the real estate market in Dubai demonstrates a genuine increase in value, unaffected by the buying panic in 2022. In the bank’s 2021 ranking, Dubai exhibits an anticipated positive trend in the property market.

Dubai is the best city for expats

According to Ahmed Al Swadi, a member of the residential properties management in Dubai, the continual enhancement of legislation in the United Arab Emirates fosters business and extends to various sectors of society and culture. This positioning makes Dubai an appealing destination for people from all over the world.

"Dubai was ranked third in the international ranking of foreign residents in 2021, as a place to live and work. We were ranked higher than major cities such as Sydney, Prague and Madrid."

The rental occupancy rate for residential buildings reached 82% out of 10,000 rental offerings from December 2020 to December 2021.

During this period, daily indices increased from an average of 15% to 28%, and monthly indices surged by 94%.

In recent years, the UAE government has made Dubai one of the most convenient jurisdictions for doing business.

Dubai today is home to 67,900 millionaires, 202 multi-millionaires (who are worth over 100 million dollars, and 13 billionaires. By 2030, the city is expected to be among the 20 richest cities in the world.

Entrepreneurs’ investments in the city are increasing in all areas of life. From the beginning of 2022, the number of properties worth AED 15 million ($4 million) has increased 4 times.

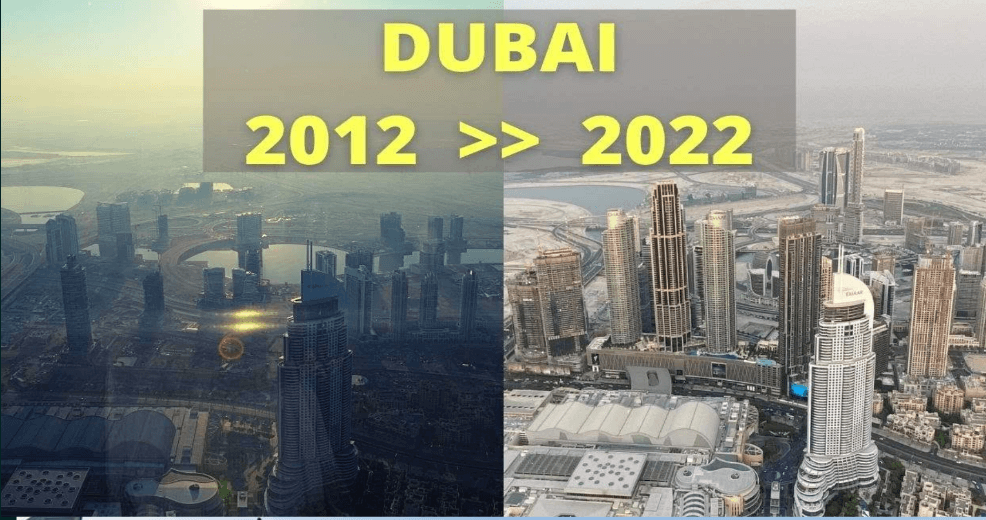

Dubai 2012 vs Dubai 2022

Economy and standard of living in the United Arab Emirates

According to the International Monetary Fund (IMF), the United Arab Emirates ranks 7th globally in gross domestic product (GDP) per capita, surpassing Austria, Germany, and the United States. The federation’s economy relies on oil and gas production, but the government allocates the profits to invest in various economic sectors. Consequently, the share of oil and gas in GDP decreased from 70% in 1971 to 30% in 2020.

Real estate prices - comparison between cities

According to the myth in Dubai the properties

The most expensive in the world, but real estate prices in the city are affordable

Relative to other popular cities in the world.

For a million dollars you can get:

In Monaco – 15 sq.m

in New York – 33 sq.m

Madrid – 106 sq.m

In Dubai you can get 137 square meters for the same price.

According to Knight Frank’s global wealth ranking, Dubai ranks first among the world’s cities in terms of luxury home prices.

How does foreign demand drive constant growth in property prices in Dubai?

According to a Reuters poll, house prices are expected to consistently rise for the next two years. This projection is based on assessments from foreign investors, who have even warned of a potentially sharp increase due to significant interest. However, with the increase in energy prices, augmented trade, and growth in tourism, the real estate market in Dubai is anticipated to gain positive and moderate momentum over the next few years.